kentucky property tax calculator

Kentucky imposes a flat income tax of 5. All rates are per 100.

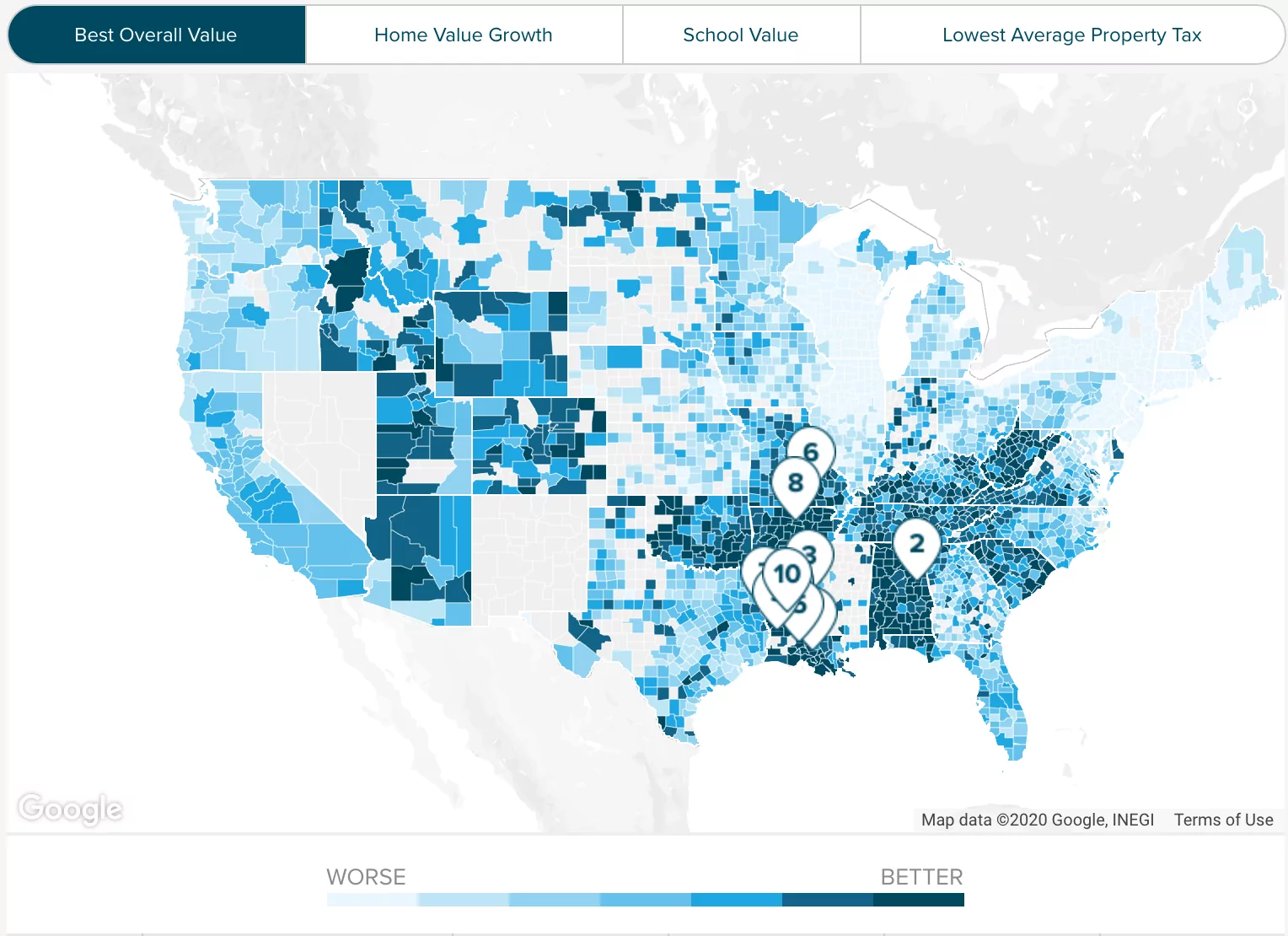

Property Tax Rate In Illinois Close To Nation S Highest City Boise City Sioux Falls

Russell County collects on average 066 of a propertys assessed fair market value as property tax.

. Our Kentucky Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Kentucky and across the entire United States. Campbell County has the highest average effective rate in the state at 117 while Carter County has the lowest rate at a mere 051. When ownership in Kentucky is transferred an excise tax of 50 for each 500 of value or fraction thereof is levied on the value of the property.

Overview of Kentucky Taxes. How Your Property Taxes Compare Based on an Assessed Home Value of 250000. The Property Valuation Administrators office is responsible for.

Explanation of the Property Tax Process. Over the years the State real property tax rate has declined from 315 cents per 100 of assessed valuation to 122 cents due to this statutory provision. The median property tax on a 15920000 house is 114624 in Kentucky.

Property tax is calculated based on your home value and the property tax rate. The median property tax on a 11790000 house is 84888 in Kentucky. Aside from state and federal taxes many Kentucky residents are subject to local taxes which are called occupational taxes.

The tax estimator above only includes a single 75 service fee. The average effective property tax rate in Kentucky is 083. Actual amounts are subject to change based on tax rate changes.

Property taxes in kentucky are relatively low. Deduct the amount of tax paid from the tax calculation to provide an illustration of your 20212022 tax refund. Counties in Kentucky collect an average of 072 of a propertys assesed fair market value as property tax per year.

The median property tax in Russell County Kentucky is 536 per year for a home worth the median value of 81400. The median property tax on a 16950000 house is 177975 in the United States. The median property tax on a 11790000 house is 86067 in Grant County.

Todays Best 30 Year Fixed Mortgage Rates. For most counties and cities in the Bluegrass State this is a percentage of taxpayers. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase.

0830 of Assessed Home Value. The tax rate is the same no matter what filing status you use. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Shelby County.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property. This rate is set annually by July 1 and it applies to all real property tax bills throughout Kentucky. Based on a 200000 mortgage.

Ad Download Property Records from the Kentucky Assessors Records. KRS 1322201aThe person who owns a motor vehicle on January 1 st of the year is responsible for paying the property taxes for that vehicle for the year. Property Valuation Administrators PVAs in each county must list value and assess the property tax on motor vehicles and motor boats as of January 1 st of each year.

Therefore the DOR Inventory Tax Credit Calculator is the. Motor Vehicle Property Tax Motor Vehicle Property Tax is an annual tax assessed on motor vehicles and motor boats. For example the sale of a 200000 home would require a 200 transfer tax to be paid.

Of course where you choose to live in Kentucky has an impact on your taxes. All property that is not vacant is subject to a 911 service fee of 75 for each dwelling or unit on the property. Kentucky Property Tax Calculator to calculate the property tax for your home or investment asset.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property. Look Up Any Address in Kentucky for a Records Report. In an effort to assist property owners understand the administration of the property tax in Kentucky this website will provide you with information that explains the various components of the property tax system.

Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another. The annual appreciation is an optional field where you can enter 0 if you do not wish to include it in the KY property tax calculator. It is based ONLY upon the taxes regarding inventory.

That is considerably less than the national median 2578 but is much higher than the state median of 1257. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Fayette County. Kentucky has one of the lowest median property tax rates in the United States with only seven states collecting a lower median property tax than Kentucky.

Thats partly because of low home values in the state the median home value is 151700 but also because of low rates. How high are property taxes in Kentucky. Kentucky has a flat income tax rate of 5 a statewide sales tax of 6 and property taxes that average 1257 annually.

The median property tax on a 13190000 house is 94968 in Kentucky. The median property tax on a 13190000 house is 84416 in Hardin County. Both the sales and property taxes are below the national averages while the state income tax is right around the US.

Payment should be made to the County. The median property tax on a 11790000 house is 123795 in the United States. Please note that this is an estimated amount.

Payment shall be made to the motor vehicle owners County Clerk. The median property tax in Kentucky is 84300 per year for a home worth the median value of 11780000. Kentucky homeowners pay 1257 annually in property taxes on average.

Keep in mind a deed cannot be recorded unless the real estate transfer tax has been collected. Most Kentucky property tax bills do not separately itemize the tax on inventory from taxes on other categories of tangible property. It is levied at six percent and shall be paid on every motor vehicle used in.

Kentucky property tax calculator to calculate the property tax for your home or investment asset. Motor Vehicle Property Tax Motor Vehicle Property Tax is an annual tax assessed on motor vehicles and motor boats. What is the Kentucky homestead exemption.

1070 of Assessed Home Value. 121 rows The states average effective property tax rate annual tax payments as a percentage of home value is also low at 083. See Results in Minutes.

Russell County has one of the lowest median property tax rates in the country with only two thousand three hundred fifty two of the 3143 counties collecting a. The median property tax on a 16950000 house is 122040 in Kentucky. Maintaining list of all tangible personal property.

The median property tax on a 15920000 house is 167160 in the United States. On average homeowners pay just a 083 effective property tax. 0930 of Assessed Home Value.

The median property tax on a 13190000 house is 138495 in the United States. Local Property Tax Rates. Use our sales tax calculator or download a free kentucky sales tax rate table by zip code.

Kentucky Property Tax Calculator Smartasset

Property Taxes Calculating State Differences How To Pay

States With The Highest And Lowest Property Taxes Property Tax States High Low

Jefferson County Ky Property Tax Calculator Smartasset

How To Calculate Debt To Income Ratio For Home Loan Google Search Debt To Income Ratio Mortgage Marketing Mortgage Approval

Best Places To Retire To Make Your Retirement Income Go Farther Seeking Alpha Income Tax Retirement Income Tax Forms

The Best States For An Early Retirement Early Retirement Life Insurance Facts Life Insurance For Seniors

Pin By Kirunda Group Corp On Real Estate Investing Being A Landlord Real Estate Investing Property Tax